Commercial

Commercial Lending

Whether you are starting a new business or are an existing business owner needing to expand, we

are eager to help. The Gifford State Bank offers a variety of commercial loans ranging from start-up business

loans, machinery purchases, or short-term operating lines of credit.

REVOLVING LINES OF CREDIT

Get the flexibility you need from the bank you trust. Our revolving lines of credit give you

quick access to cash, so you can buy inventory, cover accounts receivable, or act fast when the next opportunity

comes along.

TERM LOANS

Get a customized loan to meet your needs.

COMMERCIAL REAL ESTATE

Is it time to stop leasing and purchase your commercial property? Apply for a Commercial Real

Estate loan customized to meet your needs.

Alex Vermillion

NMLS ID 756736

Checking Accounts

Small Business/Ag Checking

- No monthly service fee up to 250 items

- Excess transactions are $0.25 per item

- Check Image Statements

- Online and Telephone Banking

- Mobile Phone and Tablet App

- Visa check card*

- $100 Minimum Opening Deposit

*Subject to bank approval.

Not-For-Profit Checking

- No monthly service fee

- Unlimited check writing

- No minimum balance requirement

- Check Image Statements

- Online and Telephone Banking

- Mobile Phone and Tablet App

- Visa Check Card*

- $100 Minimum Opening Deposit

*Subject to bank approval.

Savings Accounts

Tiered Savings Account

- Convenient & Easy Funds Transfers

- Earn Tiered Interest Monthly on Average Balance

- Up to $9,999.99

- $10,000 - $24,999.99

- $25,000 - $74,999.99

- $75,000 - Higher

- Check Image Statements

- Online and Telephone Banking

- Mobile Phone and Tablet App

- $100 Minimum Opening Deposit

Cash Management Services

The Gifford State Bank offers numerous services important to your business's daily operation such as cashier's

checks, stop payments, wire transfers and cash and coin orders. We make managing your business accounts

convenient and easy. Let our experienced business professional department help you determine which services best

fit your needs.

Cash Management

We have an Internet-based system which is more advanced than the one available to consumers. This

enables managers to create and authorize individual internal logon credentials, allowing employees

to view and or access cash management features. Online Banking gives you access to your accounts and

the movement of funds 24 hours a day, 7 days a week. You may view your account balance and activity,

reconcile your accounts using the online statements, see your pending transactions, make immediate

transfers between accounts, and download your account transactions to financial management software.

ACH Services

- Payroll services

- Credit

- Debit

eBills

- One-stop bill management tool

- Provides full PDF bill images from thousands of billers

- Automated linking

- Comprehensive setup wizard that ensures the greatest benefits and improving financial lives

BizPay

BizPay allows even small businesses to send payroll and/or direct ACH payments without the typical,

cumbersome financial reviews. Funds are guaranteed, which mitigates risk. Business owners can

delegate tasks like scheduling payments, payroll and more, while maintaining diligent oversight

Merchant Services

We are proud to partner with TIB Merchant Services which features a complete turnkey offering for your business

to accept and process payments efficiently and safely. Our full line of fast and convenient payment processing

services will provide a solution tailor-made for your business. Our next business day funding will accelerate

your cash flow and our competitive rates will help reduce your expenses. Whether you need a traditional

terminal, an e-Commerce solution, a fully functional Point-Of-Sale solution or the latest in mobile payment

technology, we provide fast and secure payment acceptance methods designed to help grow your business. We will

provide a free cost analysis and assessment to determine which payment processing solution best suits your

individual business needs. Contact us today! We look forward to working with you!

Full Service

We can offer you a full-service merchant services product to use at your storefront like a

Restaurant or Boutique. This would be a full Point of Sale Product with different system types to

meet your needs.

- Clover station- Countertop POS system with pivoting touchscreen

- Clover Mini- Accept swipe, EMV, and contactless payments.

- Clover Flex- Portable POS device.

Online

We offer web-based solutions your business can use on your computer or mobile device.

- Hosted Payments Page

- Invoicing

- QuickBooks Integration

- eCommerce Tools

- Phone Orders

- Recurring Payments

Mobile

If you are looking for something you can take on the go, we offer merchant services through your

mobile device.

- Accept Transactions through a mobile device

- Manage Cash and Credit Transactions

- Web Dashboard

- Tip Acceptance

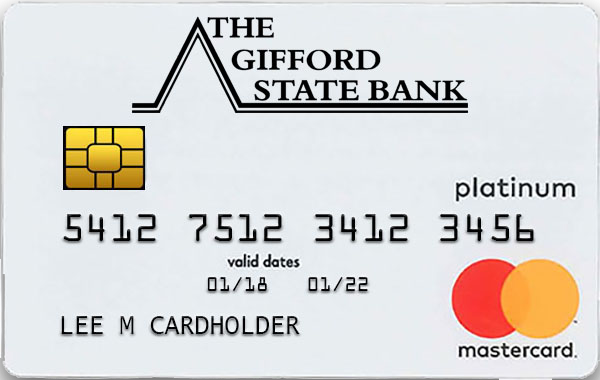

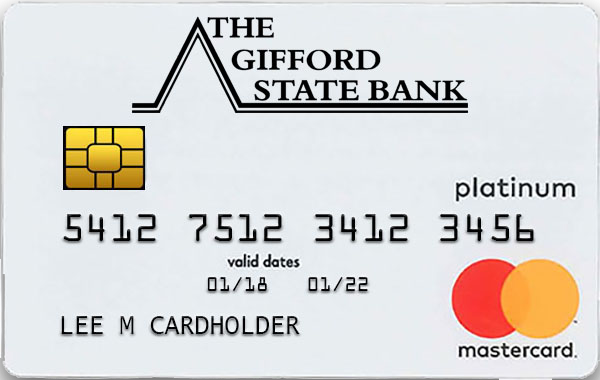

Credit Cards

Standard Business Card

Features:

- No annual fee.

- Competitive ongoing APR1.

- 25-day interest-free grace period on all purchases. No grace period on cash advances.

- Individual and summary billing options.

Benefits:

- 24-hour toll-free live customer assistance available at 800-367-7576.

- Online account information available 24/7 at www.cardaccount.net.

- Rental car collision damage waiver protection and a host of extraordinary MasterCard®

benefits.

Fees:

- Other fees may be charged, these fees are listed on the downloadable application.

Business Card / Preferred Points Rewards

Features:

- Earn one reward point for each dollar spent, up to 10,000 points per month.

- Low annual fee of $49.00 per account.

- Competitive ongoing APR1.

- 25-day interest-free grace period on all purchases. No grace period on cash advances.

- Individual billing option only.

Benefits:

- Redeem your rewards points for cash-back awards, retail gift cards, travel and a wide

variety of merchandise including cameras, mp3 players, home theater systems, portable DVD

players, sporting equipment, jewelry, luggage, electronics, video game equipment, gift cards

and more.

- To view or redeem rewards points, visit www.mypreferredpoints.com

or call 866-678-5191.

- 24-hour toll-free live customer assistance available at 800-367-7576.

- Online account information available 24/7 at www.cardaccount.net.

- Rental car collision damage waiver protection and a host of extraordinary MasterCard®

benefits.

Fees:

- Other fees may be charged, these fees are listed on the downloadable application.

Application Information

To apply electronically, click the "Apply" button above and complete the application.

Or:

- Fill out the necessary information and then print the application (you cannot save the document, so print an

extra copy for yourself), OR

- Print the application and then complete it using a blue or black pen.

Paper applications are also available at your local branch office.

Supporting documents vary depending on the type of business you have. See the chart

below.

|

Sole Proprietor |

Partnership |

Private Corporation |

Public Corporation |

Non-Profit |

| Application |

? |

? |

? |

? |

? |

| Organizational Papers |

? |

? |

? |

? |

? |

| Borrowing Resolution |

|

? |

? |

? |

? |

| Financial Statements |

|

? |

? |

? |

? |

| Personal Guaranty |

? |

? |

? |

|

|

| Personal Tax Return |

? |

? |

? |

|

|

Your completed application can be submitted in one of the following ways:

- Faxing the completed application to the Card Service Center at 877-809-9162

- Mailing the completed application to:

Card Service Center

PO Box 569120

Dallas, TX 75356-9120

- Bringing the completed application in to your local branch

1 Please see application for information about current APRs and fees.